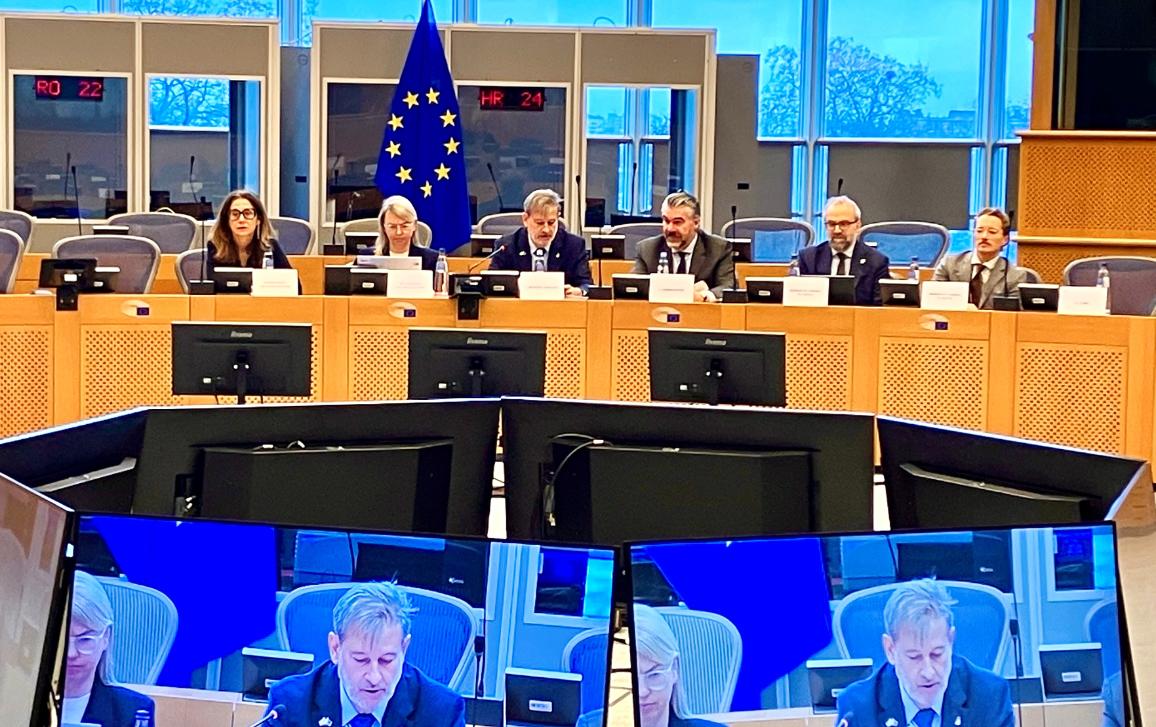

During a tense meeting of the Parliament’s taxation committee (FISC) on 20 November 2025, the European Commission defended its proposal on tobacco taxation, facing strong opposition from experts and numerous members of the European Parliament.

The objective of the hearing was to gather information and discuss tobacco taxation policies in line with the recent proposals from the European Commission. MEPs discussed the potential effects on the functioning of the Single Market of an EU harmonised taxation of novel tobacco and nicotine products and the increase of the minimum level of their taxation.

European Parliament focus on tobacco and nicotine taxation

During the debate, experts including the hearing MEPS, expressed their strong concern for the proposal of the European Commission to raise taxes on tobacco and nicotine products, including the novel ones such as pouches, e-cigarettes and vaping. They expressed also their concerns for the heavy economic and social repercussions throughout the whole value chain across Europe and as consequence loss of competitiveness for the entire Union.

The aim of the revised Tobacco Excise Directive (TED) presented in July this year is to restore the effectiveness of EU-wide minimum tax rates on tobacco products and extend their scope to cover new product types. The initiative aims to support the EU’s goal of a tobacco-free generation by 2040, recognising taxation as a key tool in reducing tobacco use.

However, the TED fails to consider the economic and social consequences for the EU including disrespect for consumers rights, impoverishment of the agriculture sector, boosting organised crime, destroying employment and production.

Europe is extremely vulnerable to tobacco smuggling because of many land borders and proximity to non-EU countries with cheap tobacco such as Belarus, Ukraine and Moldova. Hundreds of weather balloons flying across the border from Belarus to Lithuania, causing airport chaos. But the incidents also point to a long-standing, large-scale smuggling network that allegedly has high-level links in Minsk. Flying at an altitude of some 13 km the balloons grew so numerous in late October that they forced several airport closures, affecting around 140 flights and 20,000 passengers.

Taxation is a delicate balance

One of the main experts invited by the European Parliament was Professor Francesco Moscone of the University of Venice, Professor of Business Economics at Brunel University of London indicated that TED has implications that extend well beyond taxation. With an aging population, rising chronic diseases, and strained healthcare systems, revising any European directive is a chance to align tax policy with fiscal stability, public health, and economic resilience.

The design of taxation is a delicate balance act between the need to create a proper framework for a market; guarantee much-needed resources to our Member States’ struggling balance sheets; and create positive behavioural patterns in society. Overlooking these factors can lead to policy failure, causing financial and health consequences for both individual Member States and the whole EU. Ignoring well-established variables significantly increases the risk of errors, he said.

Illicit trade and Inflation

An analysis of EC data reveals a statistically significant correlation between excise taxes and illicit trade, indicating that higher tax rates are normally associated with an increase in illicit trade. Closing our eyes in front of reality leads to poor policy design. In turn, this creates a lose-lose scenario: Member States lose tax revenue, consumers do not stop smoking and are exposed to unregulated products, and criminal networks find a new, high-speed, revenue stream, the professor explained..

Any directive has systemic impacts, which should be deeply considered. This one is no different. The impact assessment states that the proposed excise adjustments could raise EU inflation by about 0.55%. This is neither a small number nor a trivial matter. Excessive inflation creates a profound negative drag on consumption, particularly within an economy experiencing a prolonged slowdown. Moreover, inflation has a direct impact on how much we spend to finance our debt, he added.

MEP Marco Falcone (EPP, IT) highlighted that various studies now show that heated tobacco, electronic cigarettes and other products such as pouches present a different health impact compared to traditional smoked products. However, the Commission’s proposal does not include a clear fiscal distinction based on health risk.

Answering a question of the same MEP if the current formulation (revised TED proposal) appropriately reflects the available scientific findings the Professor answered that we welcome this reform, but we need to be cautious. In Europe, for many other sectors, we link the final price of goods to the level of risk they pose. The same logic should apply here. We should ensure sufficient tax differentiation between high-risk products and reduced-risk products.

TED’s shortcomings

Dr Hana Ross, Senior Research Fellow, Vienna Institute for International Economic Studies & Principal Research Officer, University of Cape Town indicated that the TED Directive has several shortcomings. There is no tax adjustment for inflation/income growth leading to outdated minimum rates and a wide variation in prices across Member States. Furthermore, there are no regulations for newer tobacco/nicotine products and unjustified tax advantage for roll-your-own cigarettes.

These shortcomings, do not reduce the affordability of tobacco/nicotine products. In the contrary they encourage cross border shopping and substitution between tobacco/nicotine products instead of reducing use. This undermines the public health and revenue goals of Member States, she concluded.

MEP Fernand Kartheiser (Independent, LUX) stipulated that the additional tobacco excise duty proposed is overreaching the Commission’s competence. They propose to generate a revenue of 15 billion in the European Union, of which 11.2 billion are expected to go into the pockets of the EC. So what we are really discussing here today is an overreach of Commission competence at the expense of the competencies of the Member States in health policy. It is a further attack on subsidiarity at the competencies of the Member States in taxation policy, and all this in order to increase the financial health of the EC.

Gijs van Wijk, Policy Officer at Smoke Free Partnership said that the Commission’s proposal is essential to protect the next generation of Europeans. Raising the price of tobacco is the single most effective way to reduce consumption, especially among young people and lower-income groups. By establishing stronger minimum excise duties across Member States, this proposal takes an important step toward closing the price gaps that the tobacco industry has long exploited.

These gaps have encouraged cross-border shopping and fed misleading narratives about illicit trade — but most importantly, they have kept tobacco prices and nicotine products too low for too long, making cigarettes and other products easily accessible to young people, he added.

Christa Pelsers of Tobacco Europe, said that there is growing consensus that heated tobacco, e-cigarettes and nicotine pouches offer reduced risks compared to cigarettes and fine cut tobacco, for smokers who switch to them completely While novel products such as are addictive and not risk free, nicotine itself has not been established as a cause of cancer. Rather it is the many toxicants that are produced on burning tobacco that are the primary cause of smoking related diseases. We believe the tax treatment of these products should therefore be proportionate and reflect their potential role as alternative to smoking.

MEP Gaetano Pedullà (Left Group ,IT) indicated that maybe there’s an underlying fact which doesn’t stack up, and also when Professor Hana Ross told us that from her point of view that there is no risk of a strong market shock. We met the agriculture and manufacturing industry sector. They talked to us not about a shock but a tragic situation because they had made investments, and in particular in Italy we have a country where major investment has been made by industry. They tell us that this will have a negative impact on jobs and investment, affecting farms in particular. We on the left believe that the public should always enjoy the greatest advantage here, but causing industries to collapse is not advantageous, he concluded.

“The main objective of the proposal is not health-related”

Maria Elena Scoppio, Director at DG TAXUD, in response to MEP Marco Falcone, indicated that taxation of tobacco products already exists. It has been taxed for many years. And the main objective of the proposal is not health-related. We were, first of all, looking at the existing distortions among member states that don’t know how to tax products that are clearly substitutes for those within the scope of the directive, she said.

The illicit trade of tobacco products (ITTP), with varying magnitudes and characteristics across member states, was also a significant concern during the meeting. Some EU countries are more exposed to illicit trade for geographical reasons (bordering illegal trade hubs). In contrast, others are more exposed due to enforcement capacity deficits or widespread social acceptance of illicit product consumption.

The illegal production and trade of tobacco/nicotine products, which involves tax evasion, constitutes a significant and ongoing threat to the internal market’s functioning. It is also a serious issue in terms of revenue losses and security, as it helps finance organised crime. These criminal actions undermine tobacco control policies and have adverse public health effects by lowering the cost of tobacco products, making them more accessible to consumers. Also, it distorts competition by drawing consumers away from the legal market and causes higher inflation.

According to the European Commission the estimated foregone revenue for the EU countries associated to illicit trade of cigarettes amounts to approximately to EUR 9.0 billion while for other tobacco products – to approximately EUR 3.5 billion.