When most people think of car finance, they picture a monthly payment, a signature at the dealership, and driving away in their new car. What they don’t see is the network of control behind those deals, shaped by finance companies that operate within car manufacturers themselves.

These lenders now sit at the centre of two major scandals in Britain’s motor industry: one involving billions in potential consumer compensation, the other threatening the survival of independent dealerships.

From 2007 to 2021, many UK car finance deals used discretionary commission arrangements. Lenders allowed dealers to set interest rates within a range. The higher the rate, the more commission the dealer earned. Most consumers had no idea this could quietly add thousands to the cost of their loan. It was legal but deeply unfair and it was designed and approved by the lenders themselves.

Now the Financial Conduct Authority is reviewing thousands of complaints and may impose redress worth tens of billions of pounds. This could surpass the PPI scandal in scale. But the issue isn’t just that some drivers were overcharged. It’s that Britain’s car finance market has been shaped by lenders whose primary interest is in boosting sales and profits for the brands they serve.

Companies like RCI (which finances Renault and Nissan vehicles) and Volkswagen Financial Services are not independent brokers. They are built into the business model of the manufacturers. Their role is to make buying a car easier, yes, but also to extract value at every stage from the dealership floor to the final repayment. In doing so, they have turned both customers and dealers into tools for growth.

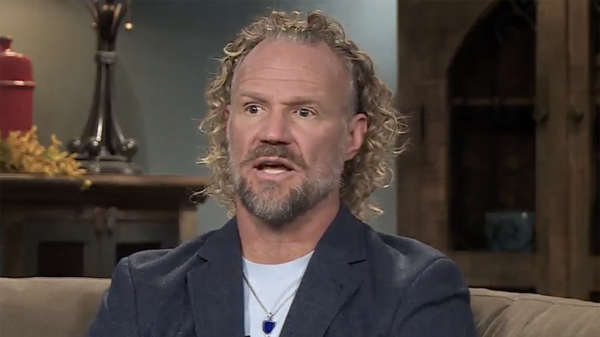

Consider Kevin Mackie, a respected Scottish dealer who ran Mackie Motors. In 2021, RCI withdrew its financial and operational support from his business with just seven days’ notice. The trigger? A single, unverified article from outside the UK, which falsely linked a former business associate of Kevin Mackie’s ex-wife to alleged money laundering. Based solely on these “unsourced allegations”, RCI Bank filed a Suspicious Activity Report (SAR) against Kevin Mackie with the National Crime Agency (NCA). Although the NCA chose not to pursue the matter, RCI proceeded to sever Mackie Motors from critical business operations.

This was a show of strength and a reminder of how much control these lenders hold when they choose to use it. The result was devastating. Seventy-five jobs were at risk of being lost and a local business destroyed; all after RCI Bank allegedly pressed its owner, Group Renault, along with Nissan Motors, to cease supply to Mackie Motors.

This is what happens when an industry becomes financialised. Access to credit, systems and stock is no longer governed by partnership or good faith, but by legal fine print and risk calculations. The same firms now preparing for redress also have the power to collapse a dealership overnight without notice or accountability.

What links the redress scandal and the Mackie case is a system that allows lenders to profit in the shadows. Consumers were left in the dark about how their loans were priced. When Kevin Mackie reached out to RCI to try and fix the situation, he too was met by silence and stonewalling. Dealers were made dependent on ongoing support to stay in business. And in both cases, the lenders could act alone.

Regulators must not let this moment pass. Compensation is necessary. But a deeper question must be asked, how have car companies and their finance arms been allowed to gain such unchecked power over the UK market?

The car finance industry has become a case study in how unchecked financial power can erode trust, transparency and competition all while appearing to offer convenience and choice. Kevin Mackie’s story is a warning. Without reform, the same firms responsible for consumer overcharging will remain free to destroy local businesses, with no explanation and no consequences.

We don’t just need refunds. We need reform.